Avery Dennison (AVY)·Q4 2025 Earnings Summary

Avery Dennison Q4 2025: EPS Beat, Stock Falls 6% on Soft Organic Sales

February 4, 2026 · by Fintool AI Agent

Avery Dennison delivered a mixed Q4 2025, with adjusted EPS of $2.45 beating consensus by 2.9% while revenue of $2.27B missed by 0.5% . Despite the earnings beat, shares fell approximately 6% in after-hours trading as investors focused on flat organic sales, tariff headwinds affecting apparel categories, and margin compression across both segments.

The quarter caps a "solid year in a dynamic environment" according to CEO Deon Stander, with FY25 adjusted EPS of $9.53 (up 1% YoY) and strong free cash flow of $707 million . High-value categories now represent approximately 45% of total revenue, up ~12 percentage points since 2019 .

Did Avery Dennison Beat Earnings?

EPS: Beat by 2.9% | Revenue: Missed by 0.5%

The EPS beat was driven by productivity initiatives and disciplined cost management, though margins contracted modestly across both segments due to higher employee-related costs .

Full Year 2025 Results:

How Did the Stock React?

AVY shares closed at $186.82 on February 4, then dropped to approximately $176.19 in after-hours trading — a decline of roughly 5.7%. The selloff reflects investor concerns about:

- Organic sales flat to down — Q4 organic sales were down 0.2%, with Materials Group organic sales down 0.9%

- Tariff impact on apparel — Trade policy continues to limit visibility with ~70% of Solutions Group sales in tariff-impacted apparel and general retail end markets

- Margin contraction — Adjusted operating margin declined 40bps to 12.4% as higher employee costs offset productivity gains

The stock had been trading near its 52-week high of $190.45 heading into earnings, suggesting the bar was high.

What Changed From Last Quarter?

Key shifts:

- Base apparel categories weakened further, down ~7% organically in Q4 vs. low-single-digit declines earlier in the year

- Intelligent Labels saw apparel/general retail categories down low-single-digits, but other categories (food, logistics) grew high-teens

- High-value categories expanded to ~45% of revenue mix, up from ~33% in 2019

What Did Management Guide?

Q1 2026 Guidance

Key guidance assumptions:

- ~$0.25 net EPS tailwind from currency translation, lower share count, partially offset by higher tax rate and interest expense

- ~$50M incremental savings from restructuring actions

- Majority of 2025 temporary savings (including incentive compensation) expected to reverse as a headwind

- Sequential earnings growth through the year with historical seasonality

How Did Segments Perform?

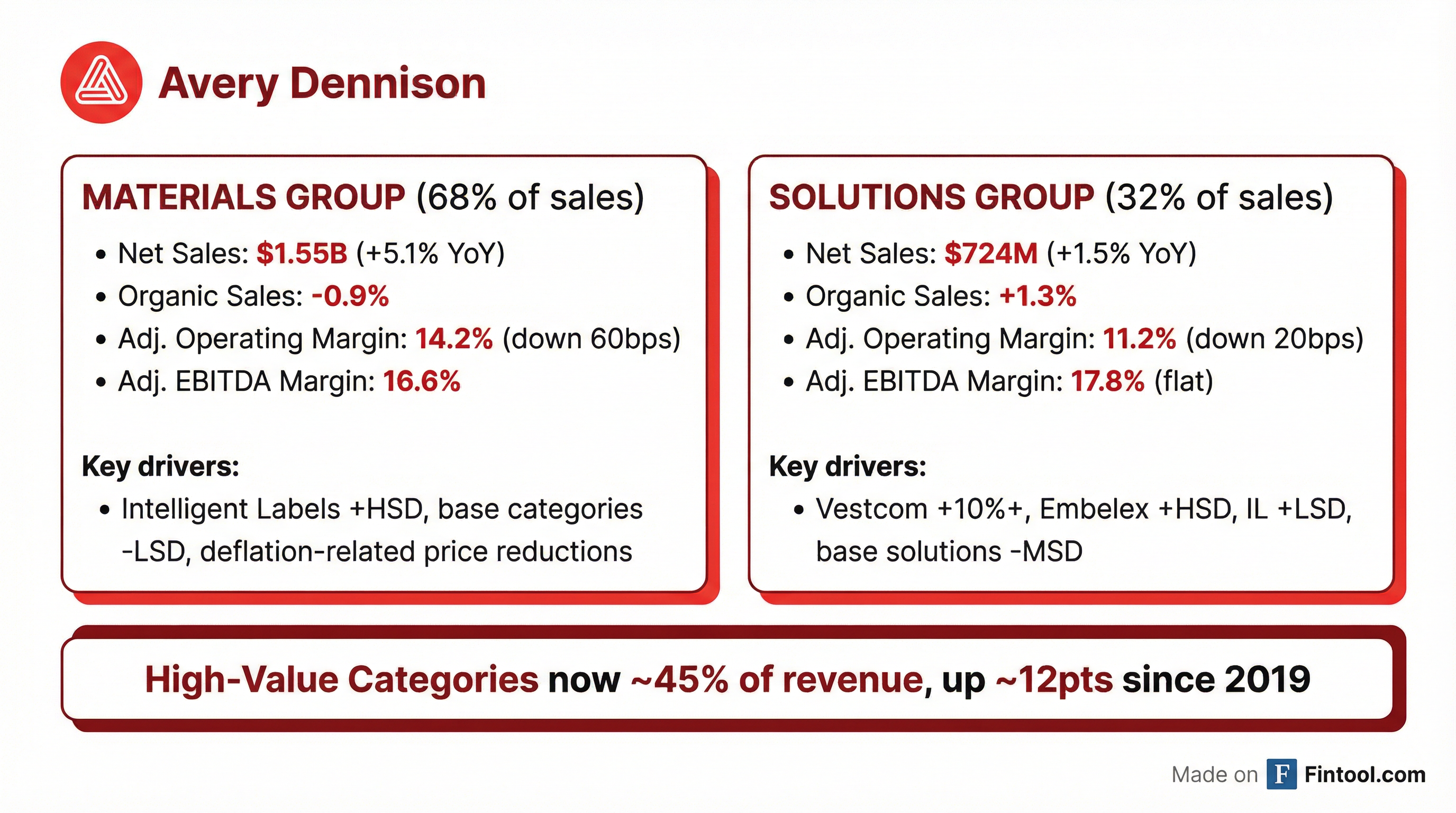

Materials Group (68% of Q4 Sales)

Key drivers:

- Low-single-digit volume/mix growth was more than offset by deflation-related price reductions

- High-value categories up low-single-digits, including Intelligent Labels up high-single-digits and Performance Materials up mid-single-digits

- Base categories down low-single-digits

- Taylor Adhesives acquisition contributed ~1 point of revenue growth

Regional Performance (Label Materials volume/mix):

- North America: Down low-single-digits on soft consumer product demand

- Europe: Up mid-single-digits

- Asia Pacific: Up low-single-digits

- Latin America: Up low-single-digits

Solutions Group (32% of Q4 Sales)

Key drivers:

- High-value categories (60% of segment) up high-single-digits :

- Vestcom up more than 10%, driven by new program rollouts

- Embelex up high-single-digits, partially driven by World Cup sales

- Intelligent Labels up low-single-digits on lower apparel/retail volumes

- Base apparel down ~7% as customers balanced inventory with post-tariff pricing decisions

- Productivity benefits and favorable high-value mix offset higher employee-related costs

Q&A Highlights: What Analysts Asked

On Materials Group margin compression (George Staphos, Bank of America): CFO Greg Lovins explained the 40bps margin decline: "Base volumes were a bit soft in the quarter, and when we look at every year we have wage inflation year-over-year, and we need a bit of volume growth to offset that wage inflation... we did have a little bit of small one-time items last year. Nothing major, but a couple items that added up to a few cents."

On Intelligent Labels growth trajectory (Ghansham Panjabi, Baird): CEO Deon Stander: "We're anticipating our growth rate in 2026 to be above what we delivered in 2025. In 2025, largely the biggest impact was really on apparel and general merchandise, really tied to the tariff activity... I still fundamentally continue to believe in the significant growth opportunity this platform has. This is a 300 billion unit plus opportunity, $8 billion plus opportunity, and we're really at the nascent stage."

On Walmart grocery rollout timing (Anthony Pettinari, Citigroup): Stander provided specific timing: "Our working assumption has always been that we would start this roughly in the third quarter. It would ramp up in the fourth quarter and then continue accelerating during 2027. As you go through both the departments — bakery, protein, and deli — as well as geographically rolling out through the stores." The rollout is expected to be worth "high single digits to low double digits" based on 2025 sales.

On quarterly guidance approach (Ghansham Panjabi, Baird): Stander on why full-year guidance isn't provided: "Over the last five years, we've seen a number of largely one-off cyclical events — pandemic, inflation, supply chain, destocking, and tariff consequences. And as a short-term cycle business, it makes having a long-term perspective during these type of events very challenging."

What Management Said About Tariffs & Apparel

CEO Deon Stander addressed the challenging macro environment:

"We delivered solid full-year results in 2025, with adjusted EPS of $9.53, reflecting the durability of our business model in a dynamic environment. Despite tariff-related impacts and softer consumer volumes, our team successfully leveraged our proven productivity playbook to maintain an adjusted EBITDA margin of 16.4%."

Tariff impact details:

- Apparel and general retail combined represent ~70% of Intelligent Labels sales and continue to be impacted by tariff pressures

- Apparel retailers changed supply chain behavior: historically placed 60% of season orders in advance and chased 40%; now placing less forward and chasing more

- Q4 apparel decline of ~7% was worse than expected — customers focused on protecting margins on lower volumes rather than chasing demand

- Apparel inventory-to-sales ratios "at one of the lowest points ever since the pandemic"

On the path forward, Stander noted: "Given that performance, I would anticipate seeing growth during this year. Certainly not in the first quarter — we lap against that non-tariff impacted first quarter of 2025. But as we move forward, all things being equal, we should see some growth."

Notable positive: High-value apparel categories continued to grow despite the base weakness, with a large apparel retailer rollout starting in late Q4 and continued interest in loss prevention applications .

Intelligent Labels: The Growth Engine

Enterprise Intelligent Labels remains the key growth driver:

Q4 2025 Performance:

- Overall sales up mid-single-digits on an organic basis

- Apparel/General retail categories down low-single-digits

- Other categories (food, logistics) up high-teens

Full Year 2025:

- Sales up low-single-digits on an organic basis

- Apparel/General retail comparable to prior year

- Other categories up ~10%

2026 Outlook:

- Food: Walmart grocery rollout expected to begin in Q3 2026, ramp in Q4 2026, and accelerate through 2027 across bakery, meat, and deli departments . Other grocers in the pipeline following the Walmart announcement, both domestic and in Europe

- Logistics: Food, logistics, and industrial categories now represent ~30% of total IL portfolio, up from lower base . Expanding pilots with additional customers; large customer provided lower volume guidance for 2026

- Apparel/Retail: Tariff uncertainty still impacting; anticipating return to growth in 2026 as new customers continue to adopt for inventory accuracy and loss prevention

Innovation & Digital Initiatives

Management highlighted several initiatives to accelerate organic growth:

AI-Driven Innovation:

"It historically has taken us anywhere from 8-10 weeks to design a new inlay in Intelligent Labels. We built with a partner a proprietary AI model that takes all of our learnings around the physics of designing inlays... and now we're able to reduce that cycle down to roughly two weeks." — CEO Deon Stander

Automation & Digital Capabilities:

- New Chief Digital Officer hired to accelerate digital transformation

- AI and IoT sensors being applied to coating assets for real-time adjustments, reducing downtime

- Automating manual finishing and packaging processes across businesses

High-Value Category Expansion:

- High-value categories now ~45% of revenue, up 12 points since 2019

- Taylor Adhesives acquisition expected to expand Materials Group high-value to 38% of segment portfolio

Capital Allocation & Balance Sheet

Notable capital actions:

- ~$390M acquisition of Taylor Adhesives expanded Materials Group high-value category exposure

- Share count down 2.9 million YoY net of dilution from long-term incentive awards

- Dividend growth maintained at ~10% CAGR over past 10 years

- Adjusted free cash flow conversion of 103% for full year

Forward Catalysts to Watch

-

Walmart Grocery RFID Rollout — Expected to start Q3 2026, ramp Q4 2026, and accelerate through 2027 across bakery, protein, and deli; worth "high single digits to low double digits" in annual value based on 2025 sales

-

Additional Grocery Pipeline — Post-Walmart announcement, "pipeline has actually grown" with multiple grocers approaching for bakery and protein solutions in both U.S. and Europe

-

Tariff Resolution — Apparel category recovery hinges on formal tariff ratification; inventory-to-sales ratios at post-pandemic lows suggest restocking potential

-

Restructuring Savings — ~$50M incremental pre-tax savings in 2026; ~two-thirds from 2025 carryover, remainder from new programs; "largely balanced across quarters"

-

AI & Automation Upside — New Chief Digital Officer; AI reducing inlay design cycles from 8-10 weeks to 2 weeks; additional productivity from IoT-enabled manufacturing

The Bottom Line

Avery Dennison delivered a modest EPS beat in Q4 2025, but the stock's 6% after-hours decline signals investor concern about stalling organic growth and persistent tariff headwinds in the apparel supply chain. The company's strategic pivot toward high-value categories — now ~45% of revenue — continues to provide differentiation, but the base business remains under pressure.

Bulls will point to:

- Consistent EPS and cash flow generation despite macro headwinds

- High-value categories growing mid-single-digits with Intelligent Labels food/logistics expanding rapidly

- Strong balance sheet with capacity for opportunistic M&A

- Q1 2026 guidance implies accelerating EPS growth (+8-10% YoY)

Bears will focus on:

- Organic sales flat to negative for four consecutive quarters

- Base apparel down 7% in Q4 with limited visibility on recovery timing

- Margin compression despite productivity initiatives

- ~70% of Solutions Group exposed to tariff-impacted categories

The near-term setup hinges on tariff resolution and the U.S. grocery RFID rollout materializing in 2H 2026. Until then, the stock may remain range-bound as investors balance proven execution against uncertain end-market demand.

This analysis is based on Avery Dennison's Q4 2025 8-K filing and earnings call transcript published February 4, 2026. For the full transcript, visit AVY Transcripts.